When WeSwap got in touch earlier this month and asked me to review a prepaid travel card, I did initially wonder if it was worth it. Sadly I’m a bit of a lazy traveller when it comes to money and whilst I do tend to go to the bank and get commission free Euros or whatever I need, I then tend to simply use my bank card to pay for meals out and about and then get annoyed at myself for all the charges I see when I come home.

My parents use a prepaid travel card and have done for a while but they are a lot more organised than me when it comes to these things, and according to the kids after this multi generation trip we’ve just been on ‘ Perhaps you’ll be more organised when you’re older Mummy’. Perhaps kids, perhaps!

AD | I have been or could be if you click on a link in this post compensated via a cash payment, gift or something else of value for writing this post. See our full disclosure policy and privacy policy for more details.

So before the trip I set about ordering a WeSwap travel card, downloading the free app and transferring some money onto the card to use on our 4 day break to Hamburg and Berlin.

So what is WeSwap?

WeSwap is a prepaid travel card service that lets you change money into foreign currency by swapping your money with other people. Instead of WeSwap using money from a bank, it swaps your money with real people in other countries directly. There’s no bank, so no middle man, which means the cost of your currency exchange is meant to be cheaper.

If I’m honest I couldn’t really get my head around this concept and wondered how it would work but then I realised I didn’t actually have to know. If it was cheaper, what did it matter where the actual money was coming from.

So what do you do to make WeSwap work?

You go online and fill in a form (takes less than 5 minutes) and then a WeSwap Mastercard is posted out to you. It takes up to 10 days (although most arrive in 3-5 days) so you do need to leave a little time before your holiday to make sure you can use it. I’d recommend setting it all up 14 days before your holiday because you get better exchange rates with more time, more on that below.

Once the card has arrived you log onto the app or the website and load on the amount of money you want – maximum £3,000 (or currency equivalent) in one transaction. This can be done by bank transfer or debit card payment and there is no fee for loading you card.

I tried the bank transfer payment first a couple of times and couldn’t get it to work, more annoyingly I couldn’t tell from the app whether it had taken the money or not. I used the web chat on the app to ask if I had managed to do it but was told that because it was the weekend I wouldn’t be able to tell until Monday. This wasn’t much help to me as the first day of my trip was Sunday, but the chat function had at least been quick and responsive to the questions I was asking.

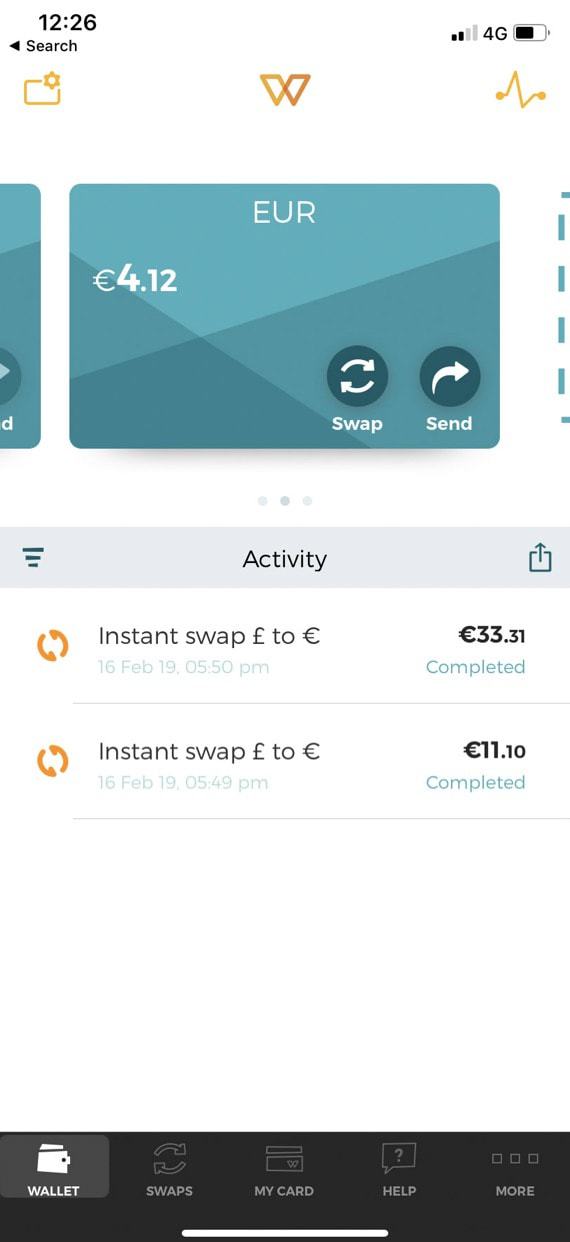

So I tried a debit card payment and that worked instantly. It was obvious in the app that the money had been added and it happened straight away. So I’d personally stick to debit card payments if I was you to load up the card.

Using WeSwap

You can use WeSwap anywhere that Mastercard is accepted and all you need to do is use your pin in the same way as you would with any other card. What I liked about the PIN and the app was that when you forgot your PIN like I did a couple of times as it was a new card, you can simply log onto the app and the app will text you the PIN straight away. I loved this.

The other great thing about WeSwap and the app is that the app keeps you updated with how much you have left on the card. Also once you have your debit card details stored in the app simply means that you can add more money onto the card if you need to.

Perks of WeSwap

You can get free cash withdrawals! You need to take out at least £200 though from an ATM – anything under that and you’ll have to pay a £1.50 charge. For each day you’re allowed a maximum limit of 10 transactions and 2 cash withdrawals, so you’d have to make sure you stick to those limits. Maximum cash withdrawal from an ATM is £500 (or equivalent) per day.

Unused currency sat at home? Send your notes to WeSwap and they will put them straight onto your WeSwap card.

Will WeSwap save you money?

It will save you more if you can leave some time for the money to be loaded onto your account. If you need it today there will be a 2% fee, if you can wait 3 days it will be 1.5% fee but if you are able to wait 7 days it’s only a 1% fee, which is why I suggested above that it’s best to get organised with WeSwap at least 14 days before you go away.

We are travelling to New York at the end of March, so if I wanted to change £100 now what would it cost me and what would I get?

If I needed the money today I would get $127.86

If I could wait 3 days I would get $128.77

If could wait 7 days then I would get $129.17

If I wait until the airport a google search suggests I would get $127.38

So if I’m organised I can save £1.79 on every £100 which isn’t to be sniffed at. If you add that to the ease of use, the ability to top up safely and easily when you’re away and the ease with which the app works with the card too, then it’s a winner. I do think it takes a little getting used to though – remembering the PIN, only trying to use where Mastercard is accepted and remembering to check how much is left on your card before you try to use it. I am however a fan though and have already topped up my card ahead of New York. Not obliged to do that at all, just genuinely think it’s worth using.

Why not sign up to WeSwap here!

If you use our code ‘MINI5’ to sign up then you get £5 loaded onto your card when you load £50! Basically free money! Why not give it a try ahead of your next trip. The first 10 people to sign up using this code and load their card will get sent a goodie bag too.

Why not PIN this post about whether Prepaid Travel Cards are worth it?

Karen Beddow founded Mini Travellers in 2014 while doing what she loves most...going on holiday!

Mini Travellers is for parents looking for holiday ideas, destination reviews, days out and things to do with the kids. We also have family travel tips, activity ideas and all other things family holiday related. Take a look at some of our latest reviews for holidays and day trips in the UK.

I used a similar card in America last year and I think one of the biggest benefits for me was being able to spread my cash across a variety of different (and easy) methods and easily keep track of it all. I was really worried if I stuck to my debit card that it might end up getting declined for an unfamiliar transaction and I love having a pre-paid card as a back up option these days.

Thanks Sam, I agree they are great and the beauty of the WeSwap card is being able to keep a track of the money you’ve spent on the app too

This sounds like a great thing to manage your money with when travelling will have to look into this for our upcoming travels.

This is really quite clever! And I like that you can keep track of payments on the app. Will have to try it for our next trip! We use a no fee credit card usually, but I like the idea of a card being topped up before we go and with better exchange rates.

We usually use a no-fee credit card when we travel but I really like this idea and love the thought of better exchange rates. I hadn’t heard of We Swap before but I’m definitely going to look into it before our next trip. Thanks!

Such an interesting idea, will have to take a closer look! Hope you had fun in Deutschland! 🙂

I’ve seen this and wondered about it. Thanks for analysing it, the numbers really help put it in perspective.